Our journey with

Win Yan Man

- Client: ABN AMRO

- Project: Upgrade Pensioen Check

- Role: Content manager & online sales specialist

- Project Duration: 11 weeks implementation

ABN AMRO

Project background

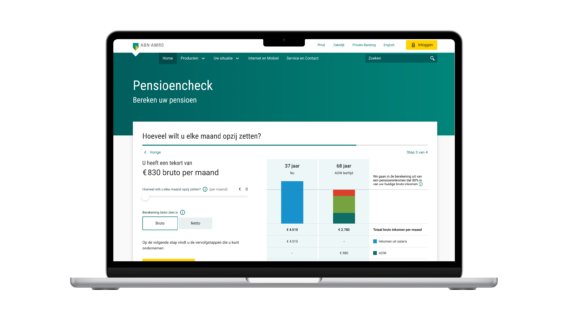

How do you provide your clients with easy and accessible insights into their pension? No complicated processes, just a simple way to answer essential pension-related questions? For ABN AMRO, this is a crucial issue because actively engaging clients can reveal whether it might be wise to save a little extra. For years, ABN AMRO’s Pension Check has proven to be a successful tool in this regard.

A modern upgrade

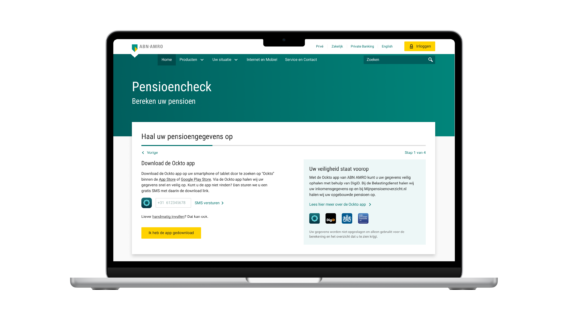

Data retrieval with Ockto

The result

The Pension Check is a collaboration between ABN AMRO, Ortec Finance, Ockto, and Yellowtail Conclusion. Thanks to the strong partnership between these parties, a well-designed and modern pension planner was created in a short period.

A few months after the successful launch of the Pension Check, we began further development. Through various user tests and analysis of quantitative data, several potential improvements and expansions of the current tool were identified. We have added the customer journey for ‘early retirement’ and implemented support for both gross and net calculations. Additionally, there is now the option to download a PDF report of the financial situation.