Our journey with

Erik van Mourik

- Client: Aegon

- Project: Empowering Customers to Make Informed Choices for a Healthy Financial Future

- Role: FinSnap by Aegon, Manager Innovation & New Business Development

Aegon

“Yellowtail Conclusion consultants distinguish themselves through their extensive knowledge of the market, financial products, and data sharing, combined with the realization of relevant customer journeys. This combination is quite unique in the market and ensures that you are fully supported in this area.”

Making informed choices for a healthy financial future

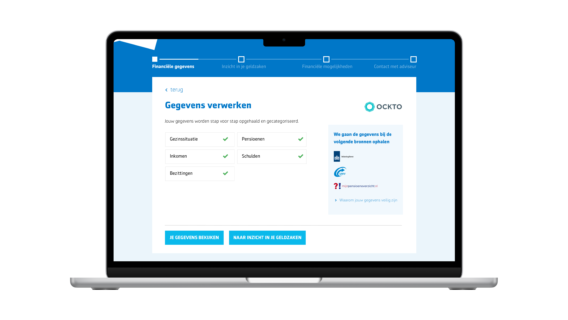

Often, consumers realize too late that there is a pension gap in their personal situation. While there are generally numerous solutions available to address this issue, it is crucial to start addressing the pension gap early on. Aegon and Yellowtail Conclusion have collaborated to develop FinSnap, aligning with Aegon’s mission to empower customers to make informed choices for a healthy financial future.

Good with Money

Personal Insight

Exploring Options

Financial insight for Aegon customers

Since its launch in September 2019, FinSnap has been generating numerous financial insights daily for consumers through Aegon, affiliated advisory firms, and employees connected to Aegon Cappital. Over 3,300 consumers have gained financial insights since the start. Initially, the tool focused on life events such as current financial status & retirement, early retirement, and reduced working hours. In the past year, additional scenarios such as job loss and death have been incorporated.