With the new pension agreement, good pension communication is more relevant than ever. It is now clear that a user-friendly website and sending letters do not sufficiently activate your participants. How do you activate the participants of your pension fund? There is no clear answer to that. Because not every participant is the same and wants the same thing. So what you need is a personalized message that personally affects a participant. A message that matches the needs of this individual person. That is how you can make an impact and create more involvement.

The problem of the ‘far-away savings pot’

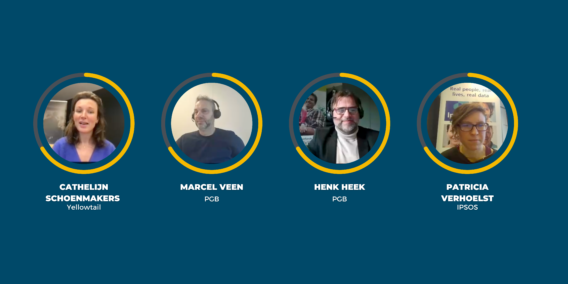

Henk Heek, Lead Client Innovation at PGB: “The pension sector is struggling with the problem of the ‘far-away savings pot’. Not only because of present bias (attaching more value to the ‘now’ than to the future.) but especially because of insufficient recognition or connection with us. We at PGB want to do more and more about that. For example in pension communication to our participants. What is someone’s lifestyle and what are his motivations from the pension context? That is something that you do not immediately see in behavior and that you would like to know for connection and relevance. If people recognize themselves in the offered style and their own motivation, they are touched more quickly in the heart. And with that we activate them to get started with their pension. Do not just pull personas off the shelf but investigate the lifestyles and motivations of your own participant population. The AFM increasingly expects this from our sector. The AFM’s Provisional Guideline Choice Guidance is a good example of this.”

Segmenting to affect

If you want to positively influence the behaviour of your participants, you need to know what drives them. That is why PGB opted for segmentation research. More and more data is being collected about participants for a personal approach, so that was a good start. Demographic segmentation, for example by age and gender, is the easiest. But demographics say little about someone’s behaviour: two people from the same postcode area, of the same gender and the same age can think completely differently about their pension. What you need is data about what actually affects people. This allows you to be relevant to participants at the right time. No overkill of information where participants have to decide for themselves what is relevant to them, but targeted, personal communication that touches on what drives these people.

Opting for nuance

Knowing someone’s motivations down to the personal level is of course the ultimate paradise. A first step is to arrive at groups of participants. That is why PGB, together with IPSOS, conducted segmentation research among 2000 PGB participants to arrive at groups of participants with similar needs. Based on this, four main segments have been defined. What they have in common is that they find control and certainty important when it comes to pensions. This also forms the basis for PGB in their future pension communication. In addition, there are important nuances in emotions and feelings. PGB is going to experiment with these differences, which make the message more personal for each participant so that they feel more addressed. Patricia Verhoelst, analyst at IPSOS: “For the majority of the population, pensions are something that is still far away and feels complex. All the more reason to look closely at motivations in communication and to address participants personally. An interesting finding was that motivations are strongly intertwined with age, but also that for younger generations, focusing on sustainability can offer interesting hooks.”

Everyone has their own customer journey

Inspired by the research of IPSOS and PGB, Yellowtail Conclusion has designed two possible customer journeys. Here, the customer journey is made as personal as possible. Anyone who enters the landing page about retiring early is asked to fill out a questionnaire. Why does this website visitor want to retire early? Is the visitor looking for certainty or is that not so important? Does the person want to know a lot about retirement or does he/she prefer to leave that to others? The reason why someone wants to retire early is often a wish. That wish can also be reflected in the customer journey. That makes it really personal for this visitor! Then someone receives the financial plan to retire early. Someone with the same question, but with little need for control, a different age and a completely different dream also goes through a completely different customer journey. This person is presented with a different tone of voice (formal or informal), look and feel and amount of information. The form differs, but for each participant it is all about being financially fit, now and in the future.

Continue testing, researching and developing

Cathelijn Schoenmakers, business development manager at Yellowtail Conclusion: “We believe in personalizing digital customer journeys. Experimenting and testing with the target group is very important in this. You really don’t have to wait until you have the perfect customer journey for your target group. The sooner you start, the more you learn. For example, we discovered that you can make people who like to be ‘in control’ see that much more is possible than they think by offering them the right information. You show this by not starting from their pension, but from the wish they have. For example, working part-time or taking a trip. In this way, you give someone control over the day and not only after retirement age. This only works if you use the right information from someone in a data-driven and well-founded way. This brings ‘difficult’ material closer and really helps someone on their way. I believe in this and at Yellowtail Conclusion we can also realize this. Above all, let go of the idea that you think you know how a participant thinks. Don’t make assumptions, but investigate what really is and take that seriously. Why do people click on something or not? Do people understand what you have written? Do they work with it? You have to keep measuring that in order to be able to continue to develop your customer journey properly. What matters is that someone recognizes and feels valued in the pension communication. That is how you strike the right chord.’