Duty of care

Suppose you are about to retire and you have the opportunity to receive a large sum of money in your account via the Lump Sum Act. You can do fun or useful things with it, such as taking that dream trip or paying off your mortgage. In any case, everyone knows what to do with an extra bag of money. But how do you know whether it is smart to use the option to withdraw 10 percent of your pension at once? It is the task and duty of care of pension funds to properly inform their pension participants about this.

An eye for consequences

There can be quite a few catches to taking that 10 percent. For example, your monthly pension payment will be lower as a result. Is that amount sufficient? Then there is no problem. In order to make that assessment, you need to know how much money you need per month after your retirement, otherwise that lower monthly payment can cause a lot of worries. There are even more factors that are important. For example, in the year that you take the 10 percent of your pension, your rent allowance could be reduced because your income exceeds the allowance limit due to that amount. Or you end up in a higher tax bracket due to the large additional amount of income, which means you have to pay much more tax. If you are not careful, you will end up with only 40% of that enormous amount that you have received. Before you opt for the lump sum, you must therefore know what the consequences of your choice are in your situation.

Feeling at ease

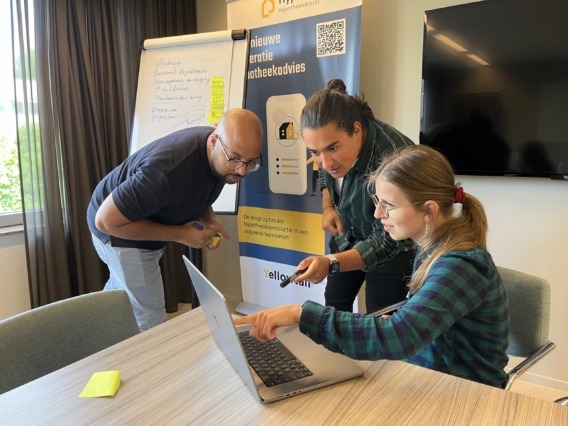

Pension funds must ensure that their participants know what they are (not) choosing. The best way to do this is in an interactive way, via an application that allows participants to create their own scenarios. For example: I want to stop working earlier and I take 10 percent of my pension in one go. What will I receive in pension per month? Or: I take 10 percent of my pension in one go and my partner will continue to work for the time being. What will our joint income look like when I retire? With these scenarios, people gain direct insight into the consequences of choices. That gives a sense of security, because no one wants unpleasant financial surprises or financial stress after retirement.

Time is running out

With just over half a year to go before the Lump Sum Act comes into effect, it is important that pension funds have a plan on how they are going to help their participants make a well-considered choice regarding that lump sum. For example, with Yellowtail’s Pension Suite. In this application, participants, pensioners and employers can find everything they are looking for about pensions. Choice guidance is included as standard. With Pension Suite, pension funds give their participants insight into the total picture of their financial situation under all kinds of different circumstances. By ‘playing’ with the scenarios, participants see the consequences of their choices regarding pensions. It is important that pension funds are aware that they cannot wait too long to offer choice guidance. They are in a position to prevent freedom of choice from leading to choice stress among their participants.