What a small office can be big at

Maarten: ‘In 2015, I started an online mortgage consultancy. In doing so, I also wanted to digitise the process. I was looking for a connection between the documents I requested from the client, the documents the client sent in, what you use from this in your advice and what needs to be sent to the lenders’ portals. But the way I envisaged this did not yet exist. I missed a solution where you have both advice and documentation and customer contact together in one place. So then I started developing such a digital environment myself. Initially, I built the platform for my own office. But I soon realised that, as a SaaS solution, this could be of interest to all advisory firms. Because the integration between advice and intermediation, that was really new. Because I had created the platform primarily from my own wishes as a mortgage adviser, it works very intuitively and easily for other mortgage advisers. That struck a chord.

Less downtime, higher customer satisfaction

Maarten explains that the biggest benefit of Hypact Advisor is that it creates much more efficiency in the process. ‘Because you streamline the whole process in one place, you have less hassle with documents and therefore less drop-outs at the lenders. This allows you as an adviser to compare offers more easily and offer customers certainty faster. The whole customer journey is one integral process. This fits in with the customer’s experience, because that is how they experience it too. With Hypact Advisor, all process steps are in the same flow, reducing customer frustration and increasing customer satisfaction. Plus, an adviser achieves all this in less time. As a result, you can help more customers in the same amount of time. An additional advantage is that with Hypact Advisor you are also immediately demonstrably compliant. Especially for the larger offices, this is important.’

Hours of profit per file

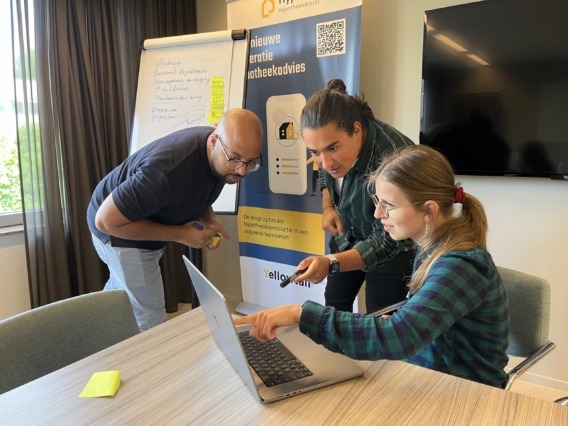

Jorik Buijs’ mortgage advice office was the second office to be connected to Hypact Advisor. Jorik: ‘I too was looking for a better digital solution. I had tried programmes in the cloud, but they didn’t work well for me. When I started using Hypact Advisor, I was immediately enthusiastic. It really is click-click-ready. I gained hours per file with that. Time I could use to advise clients. Especially as a small office, you want as many appointments with clients as possible. With Hypact Advisor, you can do that. Because it worked so well for me, I started making demos and show other mortgage advisers that with Hypact Advisor they really choose a renewed vision of mortgage advice.’

New doors

In September 2023, Yellowtail acquired the innovative mortgage SaaS platform from Maarten. From then on, it was officially named Hypact Advisor. For Maarten, this was a logical step: ‘The cooperation with Yellowtail opens new doors. With the developers, designers and consultants they have in-house, we can professionalise faster and make the platform even more successful. For instance, Yellowtail is good at developing and designing customer portals. By giving the portals the look-and-feel of a mortgage advice office, we contribute to the brand experience of that office. These are good new steps.’

Linking pin

Jorik, too, now works at Yellowtail. In addition, he is still a mortgage consultant. I act as the linking pin between Yellowtail and the mortgage offices working with the platform. I answer questions from users and contribute to the further development of Hypact Advisor. I have a lot of affinity with ICT, so for me this is a great combination. I remain a mortgage adviser to keep in touch with the profession and to keep doing the compulsory training. That still makes Hypact Advisor that unique platform for and by advisers’. Want to know more about Hypact Advisor? Check out the website.